Table of Contents

One aspect of finance often overlooked by teenagers is budgeting. As adolescents navigate the transitional phase between childhood and adulthood, understanding the significance of managing finances becomes paramount. This article, Budgeting for Teens: Building Wealth in Your Youth, is tailored to provide essential insights to teenagers, empowering them to grasp the fundamentals of budgeting and harness the potential to build wealth from an early age.

Budgeting for Teens: A Foundation for Financial Success

As teenagers embark on their journey towards independence, cultivating healthy financial habits is crucial. Learning how to budget money as a teenager sets the groundwork for a secure financial future. The ability to allocate resources wisely and make informed financial decisions is a skill that not only fosters independence but also lays the foundation for long-term success.

Understanding the challenges faced by teenagers in managing their finances, this article aims to shed light on effective budgeting strategies and provide actionable tips to navigate the complex world of money management. Whether it’s saving for college, planning for future adventures, or simply having a financial safety net, budgeting equips teens with the tools to turn their financial goals into reality.

How to Budget Money as a Teenager: Practical Tips

Budgeting for teens doesn’t have to be daunting; it can be an empowering and educational experience. By breaking down the process into manageable steps, teenagers can gain a clear understanding of their financial landscape.

In this article, we will delve into practical and realistic budgeting tips tailored specifically for teenagers. From creating a budgeting plan to identifying needs versus wants, we aim to equip teens with the knowledge and tools needed to take control of their financial journey. The journey begins with understanding income, expenses, and the importance of setting financial goals.

Invstr Jr: A Custodial Account for Teen Wealth Building

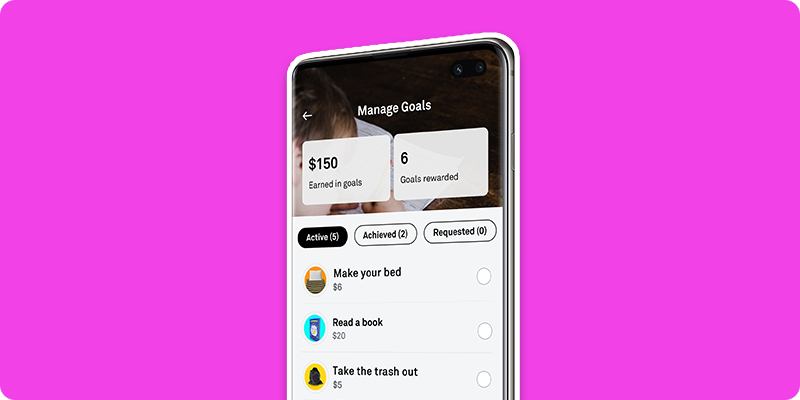

As we navigate the landscape of budgeting for teens, it’s essential to explore avenues that amplify the potential for wealth-building. One such solution that seamlessly integrates into a teenager’s financial toolkit is Invstr Jr – a custodial account designed to nurture financial acumen from an early age.

Invstr Jr serves as an innovative platform, introducing teens to the world of investing while providing a secure and controlled environment. By incorporating the Invstr Jr custodial account into their financial strategy, teenagers gain a hands-on experience in managing and investing their money. This account not only encourages responsible financial behavior but also imparts valuable lessons on market dynamics and investment strategies.

We want to empower teenagers with the knowledge and skills necessary to embark on their financial journey confidently. By emphasizing the importance of budgeting for teens, providing practical tips on money management, and introducing Invstr Jr as a valuable resource, we aim to guide the younger generation toward building a strong foundation for financial success. Stay tuned as we navigate the intricate world of budgeting for teens, unlocking the doors to a prosperous and financially secure future.

Why is budgeting important for teens?

Budgeting is a fundamental skill that holds unparalleled importance for teenagers as they navigate the maze of financial responsibilities and opportunities. Let’s delve into the key aspects that make budgeting essential for teens, providing a roadmap for building financial wealth and setting the stage for a secure financial future.

1. Building up Your Financial Responsibility

Budgeting serves as a cornerstone in the development of financial responsibility among teens. It instills a sense of accountability and discipline, encouraging them to manage their money prudently. By creating and adhering to a budget, teens learn to prioritize their spending, distinguish between needs and wants, and make informed financial decisions. This early cultivation of financial responsibility forms the bedrock for a lifetime of sound money management.

2. Improving Money Decision-Making Skills

The ability to make sound financial decisions is a skill that extends far beyond the teenage years. Budgeting empowers teens to hone their decision-making skills by evaluating income, setting priorities, and allocating resources wisely. This practical experience equips them with the confidence to make informed choices, not only in matters of personal finance but in various aspects of life where financial considerations come into play.

3. Avoiding Debt

Budgeting acts as a powerful tool in steering teens away from the pitfalls of debt. By planning and managing their finances effectively, teens can avoid the burden of accumulating debt at an early age. Understanding the consequences of overspending and learning to live within their means fosters a mindset that prioritizes long-term financial well-being over short-term gratification.

4. Financial Independence

Budgeting empowers teens to take control of their financial destiny, fostering a sense of independence. As they learn to manage their income, set goals, and make informed financial decisions, teens gain the confidence to navigate the complexities of adulthood. This financial independence not only contributes to their personal growth but also lays the groundwork for a future marked by autonomy and self-sufficiency.

Integrating Invstr Jr into Financial Independence

To enhance financial independence, consider introducing Invstr Jr, a custodial account designed to impart practical investment knowledge to teens. Through hands-on experience with Invstr Jr, teens can explore the world of investing in a controlled environment, fostering a sense of autonomy in managing their financial future.

In conclusion, budgeting for teens extends beyond mere financial management; it’s a catalyst for personal growth and long-term success. By cultivating financial responsibility, improving decision-making skills, avoiding debt, and fostering financial independence, budgeting equips teens with the tools needed to navigate the complexities of the financial world. Stay tuned as we explore more aspects of budgeting for teens, unlocking the doors to a prosperous and financially secure future.

How can teens start budgeting effectively?

Embarking on the journey of effective budgeting as a teenager may seem like a daunting task, but breaking it down into manageable steps can make the process more approachable. By understanding the key components and implementing practical strategies, teens can lay the groundwork for a strong financial future. Let’s explore the essential tips for effective budgeting and delve into why each plays a crucial role in honing budgeting skills.

Understanding Your Income

The foundation of effective budgeting lies in understanding your income. As a teenager, this may include allowances, part-time job earnings, or any other sources of income. By comprehending the inflow of money, teens can set realistic financial goals, allocate funds strategically, and make informed decisions about spending and saving.

Planning Your Expenses

Equally important is planning your expenses. List out all anticipated expenses, including necessities like school supplies, and occasional wants like entertainment. A well-thought-out expense plan ensures that every dollar has a purpose, preventing impulsive spending and encouraging responsible financial behavior.

Pick a Budgeting Strategy

Choosing a budgeting strategy that aligns with personal preferences and financial goals is a critical step. Whether it’s the 50/30/20 rule, zero-based budgeting, or any other method, having a structured approach provides a roadmap for allocating funds, saving, and managing expenses efficiently.

Spending Wisely

Spending wisely involves making conscious choices about where your money goes. By evaluating purchases against established priorities, teens can avoid unnecessary expenditures, thereby stretching their budget further. This skill cultivates financial mindfulness and contributes to the overall success of the budgeting process.

Needs vs Wants

Distinguishing between needs and wants is a fundamental aspect of effective budgeting. Understanding that not all desires are essential helps prioritize spending. This skill ensures that necessities are met before indulging in non-essential purchases, preventing overspending and contributing to the long-term stability of a budget.

Ensure You Keep Working on Increasing Your Income

While managing existing income is crucial, teens can also explore opportunities to increase their income. This could involve seeking additional part-time work, freelancing, or exploring entrepreneurial ventures. Increasing income provides more flexibility within the budget, allowing for enhanced savings and achieving financial goals faster.

Adjust Your Budget Periodically When Necessary

Flexibility is key to effective budgeting. Life circumstances, priorities, and income may change. Periodically reassessing and adjusting the budget ensures that it remains realistic and aligned with current needs and goals.

Seek Financial Advice or Help When Required

It’s okay to seek guidance. Whether from parents, teachers, or financial professionals, seeking advice can provide valuable insights and strategies for effective budgeting. Learning from others’ experiences and expertise contributes to the continual improvement of budgeting skills.

Effective budgeting for teens involves a combination of understanding income, planning expenses, picking a suitable budgeting strategy, spending wisely, distinguishing between needs and wants, increasing income, adjusting the budget when necessary, and seeking advice when required. By embracing these tips, teenagers can lay the foundation for a financially responsible and secure future. Stay tuned for more insights on budgeting for teens, unlocking the doors to a prosperous and financially secure future.

Setting financial goals is a crucial step for teens to gain control over their money and lay the foundation for a secure financial future. By following a structured approach, teenagers can identify, quantify, and work towards achieving their financial aspirations. Here’s a breakdown of essential steps to help teens set financial goals and prioritize their spending effectively.

1. Identify Their Financial Goals

The first step in setting financial goals is identifying what they want to achieve. This could range from saving for college, purchasing a high-ticket item, or building an emergency fund. By having a clear understanding of their financial aspirations, teens can tailor their budget and spending habits to align with these objectives.

2. Quantify Their Goal in Terms of an Amount

Once the financial goals are identified, the next step is to quantify them in terms of an amount. For example, if the goal is to save for a laptop, researching the cost of the desired laptop helps in establishing a concrete savings target. Quantifying the goal provides clarity, making it easier to determine how much money needs to be set aside.

3. Create a Budget Plan Focused on Income and Expenses

Creating a budget plan is the linchpin for teens aiming to set and achieve financial goals. This involves a comprehensive breakdown of income and expenses. Teens should list their income sources, whether it be allowances, part-time jobs, or other sources, and outline their monthly or periodic expenses. This budget serves as a roadmap, guiding spending habits and ensuring that there’s a dedicated portion of income directed toward achieving specific financial goals.

4. Save Consistently

Consistent saving is the backbone of realizing financial goals. Teens should prioritize saving a set amount regularly, incorporating it into their budget. This disciplined approach not only accumulates funds for the targeted goal but also fosters a habit of saving for the future. By consistently setting aside money, teens build financial discipline, laying the groundwork for responsible money management.

In conclusion, the process of setting financial goals and prioritizing spending for teens involves identifying aspirations, quantifying those goals, creating a comprehensive budget plan, and incorporating consistent saving habits. This structured approach empowers teenagers to take control of their finances, instills discipline in their spending habits, and sets them on the path to achieving their financial aspirations. Stay tuned for more insights on financial literacy and responsible money management for teens.

What are some common budgeting mistakes to avoid?

Effective budgeting is a cornerstone of financial success, but certain common mistakes can hinder progress and compromise financial stability. Understanding these pitfalls and implementing corrective measures is key for teens aiming to establish a robust financial foundation. Here are some prevalent budgeting mistakes and recommended solutions:

1. Not Actually Having a Budget

One of the most common budgeting mistakes is not having a budget at all. Without a budget, it’s challenging to track income, expenses, and savings effectively. Solution: Create a simple budget outlining income sources, planned expenses, and savings goals. Utilize budgeting tools or apps for added assistance.

2. Underestimating Expenses

Underestimating expenses is a common misstep that can lead to overspending and financial strain. Solution: Conduct thorough research to accurately estimate monthly expenses. Be realistic about variable costs and plan for unexpected expenditures.

3. Neglecting Savings

Failing to prioritize savings is a detrimental budgeting error. Without a savings cushion, unexpected expenses or emergencies can derail financial stability. Solution: Allocate a portion of income to savings consistently. Establish savings goals and treat them as non-negotiable components of the budget.

4. Impulse Spending

Impulse spending can sabotage even the most well-crafted budget. Succumbing to spur-of-the-moment purchases can erode financial discipline. Solution: Implement a waiting period for non-essential purchases. If an item is still desired after a set timeframe, include it in the budget for the next month.

5. Failing to Track Expenses

Not keeping track of expenses is a recipe for financial disarray. Without monitoring where money goes, it’s challenging to stay within budgetary limits. Solution: Regularly track and categorize expenses. Utilize budgeting apps or tools to simplify the process and gain a comprehensive view of spending habits.

6. Lack of Financial Goals

Budgeting without specific financial goals is a common oversight. Without goals, there’s a lack of direction and motivation for disciplined financial management. Solution: Clearly define short-term and long-term financial goals. Whether it’s saving for education, a car, or a vacation, having defined objectives provides purpose to the budget.

7. Not Building an Emergency Fund

Neglecting to build an emergency fund is a significant budgeting mistake. Unexpected expenses or sudden financial setbacks can be overwhelming without a safety net. Solution: Prioritize building an emergency fund. Allocate a portion of income specifically for this fund to handle unforeseen circumstances without derailing the entire budget.

In conclusion, steering clear of these common budgeting mistakes is essential for teens on the path to financial responsibility. Establishing a budget, accurately estimating expenses, prioritizing savings, resisting impulse spending, tracking expenses diligently, setting financial goals, and building an emergency fund collectively contribute to a solid financial foundation. By recognizing and rectifying these mistakes, teens can navigate the complexities of budgeting with confidence and set the stage for a prosperous financial future.

Conclusion

In the intricate landscape of personal finance, teenagers stand at a pivotal juncture where early financial education and responsible money management can shape the trajectory of their future. The journey toward building wealth and financial independence begins with a fundamental aspect often underestimated – budgeting for teens. Throughout this exploration, we’ve unraveled the significance of budgeting, delving into key aspects, tips, and potential pitfalls that teenagers may encounter on their financial journey.

Budgeting for Teens: A Pillar of Financial Success

Understanding the importance of budgeting for teens is not merely a financial lesson but a life skill that cultivates responsibility, discipline, and autonomy. From building financial responsibility and improving decision-making skills to avoiding debt and achieving financial independence, budgeting forms the bedrock for a successful financial future.

Practical Tips for Effective Budgeting

Embarking on the path of effective budgeting involves a series of practical tips tailored for teens. From understanding income and planning expenses to picking a suitable budgeting strategy and consistently saving, these steps empower teens to take control of their financial destiny. Integrating the innovative Invstr Jr custodial account into this journey provides a hands-on experience in investing for teens, fostering financial literacy and autonomy.

Setting Financial Goals: A Blueprint for Success

Teens aspiring to achieve financial success must not only grasp the fundamentals of budgeting but also learn to set and prioritize financial goals. Identifying goals, quantifying them, creating a detailed budget plan, and saving consistently form a blueprint that propels teens toward their aspirations. This structured approach instills discipline and purpose into financial management, laying the groundwork for a future marked by financial independence.

Common Budgeting Mistakes: Learning from Missteps

Avoiding common budgeting mistakes is crucial for teens seeking financial empowerment. Whether it’s neglecting to have a budget, underestimating expenses, or succumbing to impulse spending, recognizing these pitfalls and implementing corrective measures is key. Establishing a budget, tracking expenses diligently, and building an emergency fund collectively contribute to a robust financial foundation.

Empowering Teens for a Financially Secure Future

In conclusion, the journey of budgeting for teens is not just about numbers and spreadsheets; it’s about empowering the younger generation to make informed financial decisions, cultivate responsibility, and secure their financial future. By embracing the principles of budgeting, setting clear financial goals, and learning from common mistakes, teens can embark on a path of financial empowerment that transcends adolescence and sets the stage for a prosperous adulthood.

As we wrap up this exploration of budgeting for teens, remember that the lessons learned today pave the way for a financially secure tomorrow. Stay committed to the principles of budgeting, continually educate yourself about personal finance, and leverage tools like Invstr Jr to gain practical investment experience. The journey toward financial empowerment is ongoing, and with the right knowledge and habits, teens can navigate it with confidence and resilience. Here’s to a future marked by financial independence, informed decision-making, and lasting success.

All investing involves risk and can lead to losses.

Past performance does not guarantee future results.

Invstr Financial LLC (Invstr) is registered as an advisor with the SEC. Securities trading is offered to self-directed investors by Social Invstr LLC, a member of FINRA.