An investment app for minors

Teach your kids smart money management and investing with Invstr Jr.

Set them up for success

Teach your kids about money management and smart spending, in our Invstr Academy and Fantasy Finance, and help them save for a rainy day.

*Debit Card will be issued in the name of the Custodian/Parent/Guardian only.

Bank on their future

Set up a recurring or one-time allowance to reward them for completing goals.

Send money anytime, anywhere. A perfect money app for teens!

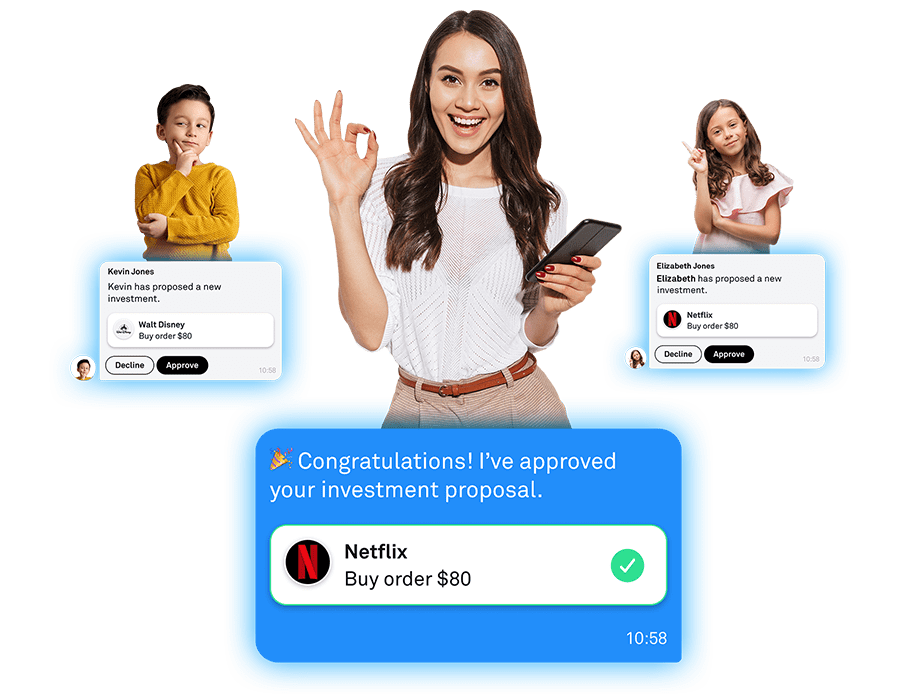

Invest together

Enjoy easy stock trading for kids, where parents and guardians can carry out trades on their children's behalf. You have total oversight!

Award-Winning Education

Enroll your child in Invstr Academy, our 10-module course on investing. Bite-sized and kid-friendly. Rated best investing app for education by Bankrate.

The best part?

You’re in control.

Parental controls make sure you’re 100% in charge and always in the know.

Get live updates when your child requests to make an investment.

Your new favorite investing app for kids and parents

When it comes to your family, there’s no better way to give your kids a head start than by investing in their financial future. With Invstr Jr’s custodial account for parents, you can create a stock trading account for minors, help them invest, and teach them about money management, smart saving, and more

Invstr Jr is a money and investment account for parents and children. Parents (also referred to as custodians or guardians) have the ability to invest for their children, send rewards for goal completion, put money toward savings, and use Invstr’s robust collection of education and resources to teach their children money management and investing strategies.

For parents, Invstr Jr works as a custodial account and investing app for minors. For children, Invstr Jr is a fantastic way to learn about investing and money management with the help of a parent or guardian.

We believe that one of the best ways to give your child a head start is to invest in their future. Invstr Jr makes it easy and fun to invest for your child by providing fractional investing from just $5, with zero commission fees. Your child can also request to buy or sell stocks, with parent approval on every trade. As well, parents are exempted from paying a gift tax of up to a maximum of $16,000 per year.

Invstr Jr costs $7.99/mo or $75/yr (a 22% discount!).

Yes – Invstr Jr is a Uniform Transfers to Minors Act [UTMA] custody account. However, it is treated as a full trust account, meaning that it is opened and managed by a designated trustee (parent or guardian) for the benefit of the minor. The parent or guardian acts as a fiduciary, meaning they have a legal responsibility to prudently oversee the minor’s investments.

Invstr Jr supports up to four children in one account.

Once a minor reaches the age of majority (currently 18 years), we will work with them to transition the account. Among other things, this will mean the minor will have to agree to a new set of documents governing our relationship. At this stage the parent/guardian will not be associated with this new account.

If you are not an existing Invstr customer, you must open an Invstr+ account first. If a link has been shared with you, follow the link to download Invstr from the Apple app store or Google Play Store. You will need to go through the onboarding process for opening an Invstr+ account. After entering your details, please have the following information for setting up the Jr account:

- Child/Children Full Name

- Child/Children Date of Birth

- Child/Children Social Security Number

If you are a child requesting an Invstr Jr account, be sure to share the link via text/email with your parent or guardian to set up their Invstr+ account and then set up your Jr account.

If you are already an existing Invstr+ customer, simply click the Jr link in the side panel and follow the steps in setting up your child’s account.

Risk Disclosure:

Brokerage services are currently only available to U.S. residents.

Invstr app and web services are provided by Invstr Ltd. Advisory services are provided by Invstr Financial LLC, an investment adviser registered with the Securities Exchange Commission (SEC) details of which can be obtained here. Securities brokerage and custody services are provided by Apex Clearing, a broker dealer registered with the SEC and a member of FINRA and SIPC. There is no bank guarantee on securities and securities may lose value.

Investing involves risk and can lead to losses. Past performance does not guarantee future results.

Watchlists provided when users first access the service are not a recommendation to invest. Instead they are provided to help users better navigate the service. Users are free to edit and create their own watchlists. From time to time, Invstr will suggest instruments solely based on an individual’s interest and the interest levels of the Invstr community. The statistical and portfolio builder models generated by Invstr do not reflect actual investment results and are not guarantees of future results. Comments provided by Invstr leaders, influencers or members of the Invstr Community are not recommendations and should not be construed as such. Invstr does not endorse the content or the positions posted by them. Their investment approach, and that of the models provided by Invstr, may be different from yours and may not be appropriate for you.